Formula 1’s Digital Strategy

Living.Lab undertook a project that would lay the foundation for the digital transformation of Formula 1, redefining the sport’s relationship with its fans

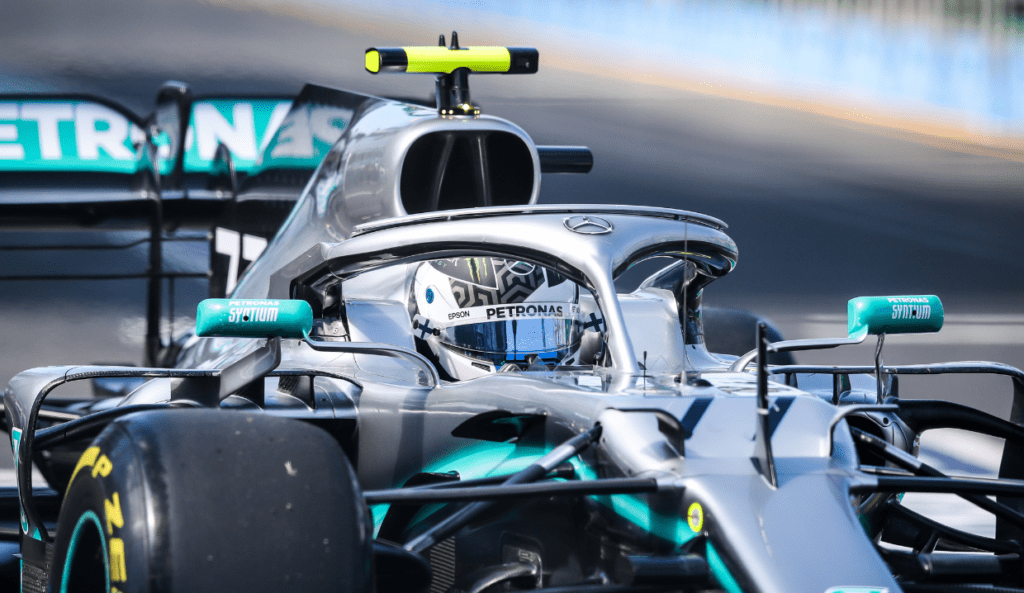

Motorsport is a technology incubator that drives breakthroughs in high-value engineering (HVE), advanced manufacturing, and sustainable powertrains.

Living Lab partnered with the UK Government to develop a motorsport-driven high-value engineering strategy, leveraging the industry’s expertise to enhance R&D, manufacturing innovation, and industrial competitiveness.

The UK motorsport industry is a global leader in high-performance engineering, with £7.1 billion in annual sales and 38,500 jobs in automotive technology, composites, and energy-efficient drivetrain development.

By transferring motorsport innovation the sector fuels advancements in:

Motorsport can have a transformative effect on industrial innovation, driving economic growth through high-paying R&D and manufacturing jobs. When anchored by motorsport, and the advanced industrial processes the participants inspire, nations unlock a powerful engine for progress. Motorsport, in particular, sits at the intersection of high-value engineering (HVE) and cutting-edge technology, delivering advancements that ripple across industries such as automotive, aerospace, clean energy, and advanced manufacturing.

Every great project begins with a bold vision. Harnessing motorsport’s culture, processes, and technologies to supercharge the UK’s HVE research and manufacturing sector was ambitious—and complex. Motorsport thrives on competitive advantage, where technological breakthroughs remain highly protected. Teams guard their innovations, preferring to iterate rapidly rather than patent them.

Our challenge? To take the competitive edge found in motorsports innovation and translate it into an actionable strategy that would drive economic transformation, innovation, and long-term competitiveness.

We transformed an ambitious vision into a clear, actionable strategy for a motorsport-driven high-value engineering hub. Starting with an in-depth feasibility study, we:

The result? A strategic roadmap combining modern infrastructure, shared facilities, event programming, and skills development to position the hub as a magnet for R&D, investment, and job creation.

Our approach was realistic, data-driven, and collaborative—challenging assumptions, mapping pathways to success, and delivering a practical blueprint for long-term economic transformation.

Manufacturing is a global engine of economic growth, representing over £6.7 trillion globally and contributing significantly to national GDP, innovation, and employment.

In the UK, high-value manufacturing (HVM) accounts for 10% of Gross Value Add (GVA), half of all exports, and three-quarters of the nation’s business R&D. But this sector is not just about economic metrics. It is the catalyst for transforming nations’ innovation ecosystems, strengthening industrial clusters, and unlocking long-term competitive advantage.

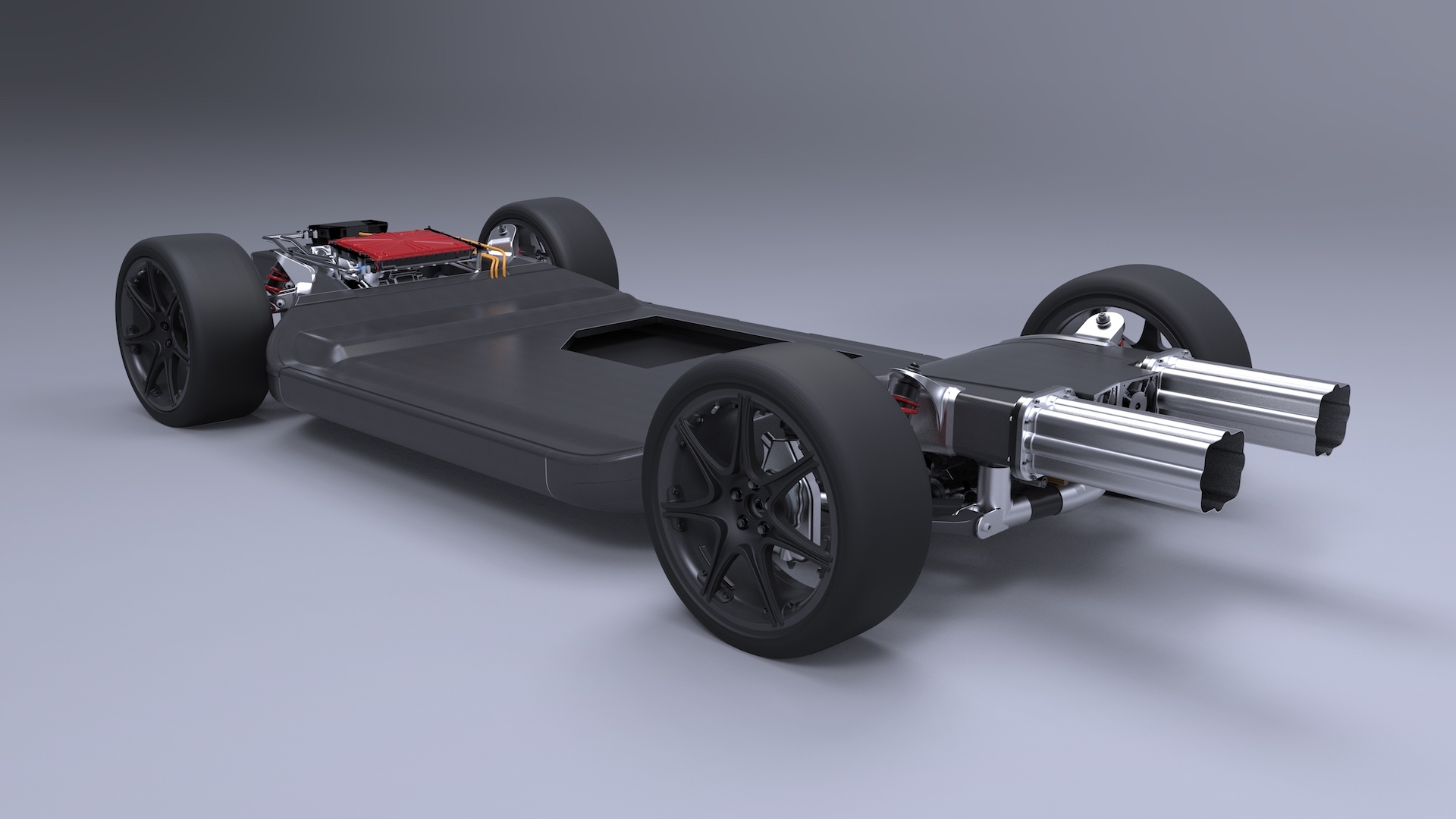

High-Value Engineering (HVE) sits at the nexus of this transformation. With motorsport as a strategic anchor, nations can propel advanced technologies, from sustainable powertrains to composites and additive manufacturing. The UK motorsport industry is a global leader in HVE with £7.1bn in sales generated from 4,500 SMEs. The industry supports 38,500 full and part-time jobs, including 25,000 engineers. Alongside that, the HVE segment of UK manufacturing accounts for 35% of all exports and contributes £151bn worth of value toward the UK’s balance of payments.

Motorsport-developed industrial processes such as non-destructive testing, simulation and manufacturing processes, short timescales and so on are increasingly relevant to mainstream manufacturing. Companies such as Prodrive, Williams Advanced Engineering, Ricardo, Xtrac, McLaren Applied Technologies and many less well-known names are all developing stand-alone businesses to commercialize motorsports-related technologies, such as active aerodynamics, composites, advanced gearboxes, high-output diesel engines and energy-efficient drive trains.

We transformed an ambitious vision into a clear, actionable strategy for a motorsport-driven high-value engineering hub.

Starting with an in-depth feasibility study, we:

We benchmarked against leading global hubs like San Jose-San Francisco and San Jose-San Francisco, Cambridge in the United Kingdom, Daejeon Germany’s advanced automotive clusters in Bavaria and Cologne, identifying what made them thrive.

We analysed economic data, industry trends, and motorsport’s role in driving innovation—such as its rapid advancements in sustainable powertrains, aerodynamics, and composites.

From OEMs and SMEs to policymakers, universities, and race teams—to uncover priorities and opportunities. That’s where we find the Living.Lab chemistry.

We met with more than 40 organisations across motorsport and high-value engineering, including educational institutions like Cranfield University, major automotive manufacturers such as Hyundai, Volkswagen, Lotus and Nissan, and leading parts suppliers like Ricardo and Magneti Marelli. Insights were also gathered from prominent race teams, including Williams F1, and McLaren. This breadth of input highlights the critical roles of education, R&D, OEM innovation, and race team operations in shaping the future of motorsport and high-value engineering industries.

The interviews provide a clear roadmap for how motorsport-driven hubs can be strategically developed and scaled. We can extract actionable insights that inform hub design, stakeholder alignment, and long-term success.

Insight: Volkswagen currently invests more in R&D than any other company worldwide, outpacing the likes of Apple, Samsung and Microsoft, whose lifeblood is technological advancement. Additionally, there are 2 automakers in the top 10 R&D spenders, 8 in the top 25, and 11 among the top 50. This dominance reflects on the role motorsport can take as a technology incubator.

Planning Response: Integrate Motorsport-developed industrial processes such as non-destructive testing, simulation and manufacturing processes, and short timescales into mainstream manufacturing. Auto manufacturers and OEMs are better placed to commercialise motorsports-related technologies, such as active aerodynamics, composites, advanced gearboxes, high-output diesel engines, composite bonding, battery tech, BMS systems, and energy-efficient drive trains.

Outcome: A self-sustaining ecosystem where motorsport innovation drives value into adjacent industries like automotive, aerospace, and green tech.

Insight: OEMs and race teams cited the need for cost-effective, shared facilities to lower the barriers to entry for SMEs and drive innovation.

Planning Response:

Outcome: Hubs that operate as magnets for global investment and industry clustering, maximising occupancy and economic outputs.

Insight: The German model of long-term guaranteed university funding for development technologies underscores the importance of linking skills pipelines to industry needs.

Outcome: A pipeline of future-proof talent and a dynamic hub that fosters both commercial and academic innovation

Insight: Emphasise the role of visibility and branding in securing commercial success for hubs.

Insight: Stakeholders highlighted the need for clear policies, incentives, and government-backed support to drive momentum.

Planning Response: Build a framework of:

Outcome: A competitive, business-friendly environment that accelerates growth and attracts long-term tenancy.

By combining motorsport’s unique innovation ecosystem with funding mechanisms, workforce development, and sustainability practices inspired and existing government HVM programmes, the strategy delivered measurable outcomes. These include accelerated R&D, increased industry participation, and global investment—creating a blueprint for economic transformation and industrial success.

There are now seven cutting-edge UK high-value manufacturing centres which reduces the cost of innovation and allows SMEs, Tier 1 suppliers, and OEMs access to advanced facilities such as composite labs, CFD testing platforms, and additive manufacturing centres.

Facilitated partnerships between motorsport teams and other industries to accelerate technology transfer (e.g., sustainable propulsion systems, lightweight materials, and advanced energy recovery systems).

TOYOTA Motorsport GmbH (TMG) has partnered with the University of Sheffield’s AMRC to pioneer advanced lightweight materials and manufacturing processes. Combining TMG’s expertise in CNC, composites, and additive manufacturing with the AMRC’s cutting-edge research, the collaboration enhances performance and keeps TMG at the forefront of automotive technology.

This partnership leverages horizontal innovation to transfer technologies from other industries into motorsport, driving faster, leaner, cleaner solutions while cementing the AMRC’s role as a hub for high-value engineering.

Integrated government-backed incentives including R&D tax credits, enterprise zone grants, and innovation vouchers to de-risk investments and attract international players.

Enabled access to public-private funding streams for prototyping, testing, and scaling breakthrough technologies.

Apprenticeships and Training Pathways: Develop industry-focused apprenticeships and hands-on technical training in areas like composites, digital manufacturing, and additive technologies.

Upskilling Programmes: Deliver tailored CPD courses for existing employees, enabling SMEs, OEMs, and Tier 1 suppliers to adopt emerging technologies and processes.

STEM Engagement: Promote STEM learning through partnerships with universities and technical institutes, aligning research and teaching with motorsport and high-value engineering demands.

Workplace Integration: Embed on-the-job learning by combining real-world motorsport projects with structured educational pathways to accelerate talent readiness.

WMG addresses the skills shortage facing industries by delivering applied learning that drives immediate impact. Its short courses, developed with industry input, focus on key areas like Engineering, Automotive Electrification, Battery Engineering, and Digital Manufacturing.

Designed for efficiency, the courses equip employees with future-ready skills to boost productivity and adapt to evolving job roles. Taught by industry practitioners, WMG empowers businesses to stay ahead of the curve and future-proof their workforces.

A significant outcome of the project was the alignment with UKTI’s GREAT Britain Campaign, leveraging Formula 1’s global platform to showcase the UK’s leadership in creative industries, technology, and branding excellence.

The campaign included a Creative Industries and Motorsport Seminar at the Brazilian Grand Prix, where UK companies—spanning design, technical innovation, and architecture—had an opportunity to promote their expertise to senior executives, government officials, and academics.

Notably, McLaren F1 partnered with the GREAT Britain Campaign to highlight the UK’s innovation ecosystem on an international stage. This collaboration demonstrated how motorsport can amplify the UK’s strengths in engineering, sustainability, and advanced manufacturing while promoting British talent in high-performance sectors.

Through events, curated displays, and the GREAT-branded brochure, this initiative created lasting connections, fostered commercial opportunities, and reinforced the UK’s position as a global hub for motorsport and industrial innovation.

A core outcome of the project was the development of a robust framework for policy and incentives, which the UK’s Catapult Network model has successfully fostered.

Action:

Results:

UK motorsport is now a model for policy-driven innovation ecosystems, underpinned by public-private collaboration and sustained funding.

By combining motorsport’s unique innovation ecosystem with funding mechanisms, workforce development, and sustainability practices inspired by the HVM Catapult, the hub delivered measurable outcomes. These include accelerated R&D, increased industry participation, and global investment—creating a blueprint for economic transformation and industrial success.

Takeaways

Living.Lab undertook a project that would lay the foundation for the digital transformation of Formula 1, redefining the sport’s relationship with its fans

Living.Lab partnered with MotoGP to elevate ticket sales for the UK promoter, delivering a comprehensive strategy rooted in pricing optimisation, digital marketing innovation, and a seamless customer journey.

Driving the UK’s High-Value Engineering Revolution through Motorsport

Let’s build the future together